401K Programs only allow you to invest in paper products like stocks, bonds and money markets. As a result, you cannot own physical gold and silver in your 401 K.

You can Roll Over Your 401K to our Physical Possession IRA and still maintain the tax deferral for retirement. However, if you are currently with an employer, no rollover is permitted, and you can only borrow against your 401K for hardship conditions.

So, Consider the following:

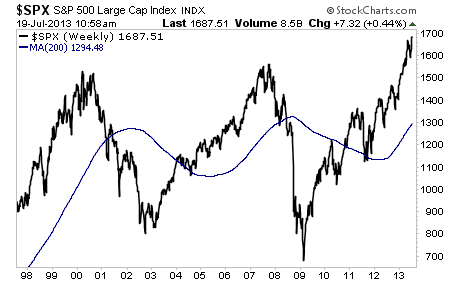

1. Stocks have hit their high point. The same goes for most ETFs and Mutual Funds. The Same holds true for a bond portfolio.

2. The stock market lost 50% of its value in 2001 and 60% in 2007-2008. The bond market was also trashed. Your 401K probably lost half of its value both times. It doesn't have to happen again.

Here is how to minimize your risk as much as possible:

1. Move 90% of your 401K funds into a Market Fund or Guaranteed Fund. The key here is to not lose your money again.

2. Move 10% of your money into an ETF like SLV or GLD. Paper Silver and Gold, while not the best way to go, will still appreciate dramatically like they did in 2001 and 2007.

3. If you have an IRA or 401K from a previous employer, role into our Physical Possession IRA. This will allow you to have possession of your wealth when the economy turns bad. This time, it will turn really bad.

4. If you are uncomfortable with number 3, turn as large a percentage into Gold and Silver using our Physical Possession IRA as you are comfortable with.

More in the Next Article: